|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

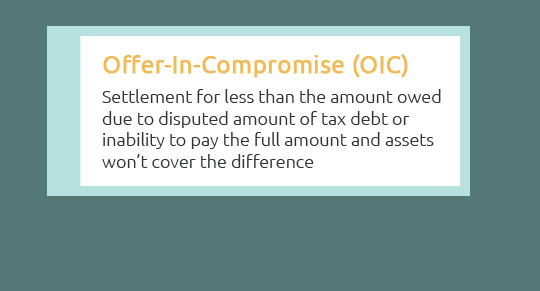

Struggling under the weight of tax debt? Our expert tax debt attorneys are your lifeline, cutting through the chaos to offer you a clear path to freedom-because taxes on debt settlement don't have to be a nightmare; they're just another hurdle we are trained to clear, turning the impossible into possible, and the overwhelming into a manageable plan, so you can regain control of your finances with confidence and peace of mind-it's time to rewrite your financial future.

https://www.lendingtree.com/credit-repair/tax-implications-of-settling-your-debt/

Settled debt is considered income by the IRS, so you'll have to pay income taxes on the forgiven amount. Creditors will send you a 1099-C form ... https://www.superlawyers.com/resources/tax/personal-taxes/do-i-have-to-pay-taxes-on-debt-settlements/

Notifying the IRS of a Debt Settlement with IRS Form 1099-C; Exceptions to Paying Taxes on Debt Settlements; Find Experienced Legal Help. For ... https://www.wtaxattorney.com/tax-problems/forgiven-liabilities/

There are no direct taxes on a debt settlement, but if you save $600 or more, you will have to report the savings as income. To continue with the above example, ...

|